- Home

- Figures

- Foreword

- Executive Board

- Share

- Strategy

-

Management report

- Foundations of the Group

- Report on economic position

- Other success factors

-

Opportunity and risk report

-

Risk report

- Strategy implementation

- Major external factors

- Risk capital

- Risk management

- Risk management system

- Internal control system

- Risk landscape of Hannover Re

- Internal risk assessment

- Underwriting risks in property and casualty reinsurance

- Underwriting risks in life and health reinsurance

- Market risks

- Counterparty default risks

- Operational risks

- Other risks

- Opportunity report

-

Risk report

- Enterprise management

- Outlook

- Accounts

- Supervisory Board

- Sites

Opportunity report

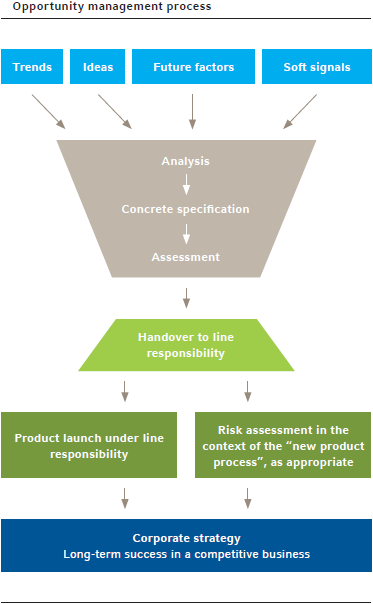

Speed is one of the qualities used to measure a successful knowledge transfer. Quick solutions and staying one step ahead of the competition is the name of the game. Hannover Re searches systematically for new business opportunities in order to generate sustainable growth and strengthen the company’s profitable development. With a view to identifying opportunities and successfully translating ideas into business, Hannover Re adopts a number of closely related approaches in order to achieve holistic opportunity and risk management. Of significance here is the interplay without overlaps of the various functions within opportunity and risk management, which is ensured by defined interfaces.

Key elements in Hannover Re’s opportunity management include its various market-specific innovations in the Life & Health and Property & Casualty reinsurance business groups (see the Forecast). What is more, innovative and creative ideas are developed by our employees. Those that can be successfully translated into additional profitable premium volume are financially rewarded. Further elements are the working group on “Emerging Risks and Scientific Affairs” and the “Future Radar” initiative.

Not only that, Hannover Re has set up an organisational unit for “Innovation Management” within the Chief Executive Officer’s scope of responsibility. This service unit deals systematically with ideas and potential business possibilities and it concentrates its activities on opening up additional growth opportunities. To this end, promising opportunities are translated into business models with the support of project teams. New solutions that meet with a positive response are subsequently launched on the market in cooperation with primary insurance partners. The goal is to cultivate new business and thereby promote Hannover Re’s profitable growth. Several of the more than 115 ideas contributed by the global network since the unit was set up have been realised as innovative insurance solutions and successfully handed over to line responsibility; they are now being sold on the market by primary insurers.

A key project conducted in 2016 went by the name “Journey Re”. It forged a connection to students, university graduates and young professionals with a view to developing new business models for primary insurance and reinsurance and translating the creativity that exists outside the industry into new business opportunities. The project activities were focused on locations in Berlin, Dublin, Boston and Johannesburg.

The networking of the innovative minds involved gives rise to close links with other projects, working groups and bodies, such as with the working group on “Emerging Risks und Scientific Affairs” in regard to emerging risks and opportunities (see page 94 et seq. “Other risks”). This working group carries out qualitative assessments of emerging risks. As a result, however, not only are the potential risks explored but also any available business opportunities. In the year under review, for example, issues such as “Political crimes” and “Regulatory environment” were analysed by the working group.

Cyber risks

Cyber attacks on critical systems are becoming increasingly common. They can cause considerable financial losses and also damage corporate reputations. Not only that, they can severely hamper private and public life, especially if critical infrastructures are impacted – such as the health, transportation / traffic and energy sectors. In such instances supply bottlenecks with lasting effects as well as major disruptions to public safety may ensue. In a networked world the repercussions of cyber attacks are intensifying because the volume of data stored around the world is constantly growing – and in this context it is not only one’s own technical infrastructure that needs to be secured. On the contrary, the trend towards cloud computing is increasingly shifting the focus to third-party infrastructures and the associated network connection. As part of our holistic risk and opportunity management activities, we are also tackling the question of what new insurance products can be developed in order to protect against the relevant threats. Our presence in this market thus goes as far back as 2007 and we have already developed corresponding products.

If a business idea is translated into reality and a new reinsurance product results, the normal procedure – provided the criteria defined for this purpose by Risk Management are applicable – is to work through the so-called new product process. This process is supported by Risk Management at Hannover Re. The process is always worked through if a contractual commitment is to be entered into in a form not previously used by Hannover Re or if a new type of risk is to be insured. If this is the case, all material internal and external influencing factors are examined beforehand by Risk Management (e. g. implications for the overall risk profile or the risk strategy) and evaluated. Risk Management ensures that before it can be used or sold a new reinsurance product must be approved by the Executive Board.