- Home

- Figures

- Foreword

- Executive Board

- Share

- Strategy

-

Management report

- Foundations of the Group

- Report on economic position

- Other success factors

-

Opportunity and risk report

-

Risk report

- Strategy implementation

- Major external factors

- Risk capital

- Risk management

- Risk management system

- Internal control system

- Risk landscape of Hannover Re

- Internal risk assessment

- Underwriting risks in property and casualty reinsurance

- Underwriting risks in life and health reinsurance

- Market risks

- Counterparty default risks

- Operational risks

- Other risks

- Opportunity report

-

Risk report

- Enterprise management

- Outlook

- Accounts

- Supervisory Board

- Sites

Underwriting risks in property and casualty reinsurance

Risk management in property and casualty reinsurance has defined various overall guidelines for efficient risk steering. These include, among other things, the use of retrocessions to reduce volatility and conserve capital. It is also crucially important to consistently maximise the available risk capacities on the basis of the risk management parameters of the Hannover Re Group and to steer the acceptance of risks systematically through the existing central and local underwriting guidelines. Our conservative reserving level is a key factor in our risk management. We make a fundamental distinction between risks that result from business operations of past years (reserve risk) and those stemming from activities in the current or future years (price / premium risk). In the latter case, special importance attaches to the catastrophe risk.

Diversification within the Property & Casualty reinsurance business group is actively managed through allocation of the cost of capital according to the contribution made to diversification. A high diversification effect arises out of the underwriting of business in different lines and different regions with different business partners. In addition, the active limitation of individual risks – such as natural catastrophes – enhances the diversification effect. The risk capital with a confidence level of 99.5% for underwriting risks in property and casualty reinsurance breaks down as follows:

| Required risk capital 1 for underwriting risks property and casualty | |||||

| in EUR million | 31.12.2016 | 30.9.2015 | |||

|---|---|---|---|---|---|

| Premium risk (including catastrophe risk) | 2,470.4 | 2,237.4 | |||

| Reserve risk | 2,281.8 | 2,292.5 | |||

| Diversification | (1,199.3) | (1,121.0) | |||

| Underwriting risk property and casualty | 3,552.9 | 3,408.9 | |||

| 1 Required risk capital at a confidence level of 99.5% | |||||

The largest share of the required risk capital for the premium risk (including catastrophe risk) is attributable to risks from natural disasters. The following table shows the required risk capital for our four largest natural hazards scenarios:

| Required risk capital 1 for the four largest natural hazards scenarios | |||||

| in EUR million | 2016 | 2015 | |||

|---|---|---|---|---|---|

| Hurricane US / Caribbean | 1,477.3 | 1,338.0 | |||

| Earthquake US West Coast | 1,035.8 | 1,103.9 | |||

| Winter storm Europe | 698.8 | 828.6 | |||

| Earthquake Japan | 750.4 | 780.0 | |||

| 1 Required risk capital with a confidence level of 99.5% on an aggregate annual loss basis | |||||

The reserve risk, i. e. the risk of under-reserving losses and the resulting strain on the underwriting result, is a high priority in our risk management. We attach the utmost importance to a conservative reserving level and therefore traditionally have a high confidence level (> 50%). In order to counter the risk of under-reserving we calculate our loss reserves based on our own actuarial estimations and establish, where necessary, additional reserves supplementary to those posted by our cedants as well as the segment reserve for losses that have already occurred but have not yet been reported to us. Liability claims have a major influence on the segment reserve. The segment reserve is calculated on a differentiated basis according to risk categories and regions. The segment reserve established by the Hannover Re Group amounted to EUR 7,413.6 million in the year under review.

The statistical run-off triangles are another monitoring tool used by our company. They show the changes in the reserve over time as a consequence of paid claims and in the recalculation of the reserves to be established as at each balance sheet date. Their adequacy is monitored using actuarial methods.

Our own actuarial calculations regarding the adequacy of the reserves are also subject to annual quality assurance reviews conducted by external firms of actuaries and auditors. For further remarks on the reserve risk please see our comments in section 6.7 Technical provisions.

In the case of asbestos- and pollution-related claims it is difficult to reliably estimate future loss payments. The adequacy of these reserves can be estimated using the so-called “survival ratio”. This ratio expresses how many years the reserves would cover if the average level of paid claims over the past three years were to continue.

| Survival ratio in years and reserves for asbestos-related claims and pollution damage | ||||||

| 2016 | 2015 | |||||

|---|---|---|---|---|---|---|

| in EUR million | Individual loss reserves | IBNR reserves | Survival ratio in years | Individual loss reserves | IBNR reserves | Survival ratio in years |

| Asbestos-related claims / pollution damage | 35.5 | 210.5 | 24.6 | 36.0 | 203.3 | 26.9 |

In order to partially hedge inflation risks Hannover Re holds inflation-linked instruments in its portfolio that protect parts of the loss reserves against inflation risks. An inflation risk exists particularly inasmuch as the liabilities (e. g. loss reserves) could develop differently than assumed at the time when the reserve was constituted because of inflation. This inflation protection was initially ensured by way of inflation swaps. From 2012 onwards we also increasingly obtained parts of the inflation protection for our loss reserves by purchasing bonds with inflation-linked coupons and redemption amounts. In 2015 the inflation protection was converted to the exclusive use of such bonds.

Licensed scientific simulation models, supplemented by the expertise of our own specialist departments, are used to assess our material catastrophe risks from natural hazards (especially earthquake, windstorm and flood). Furthermore, we establish the risk to our portfolio from various scenarios in the form of probability distributions. The monitoring of the risks resulting from natural hazards is rounded out by realistic extreme loss scenarios.

| Stress tests for natural catastrophes after retrocessions | ||

| Aggregate annual loss1 | 2016 | 2015 |

|---|---|---|

| in EUR million | Effect on forecast net income | |

| Winter storm Europe | ||

| 100-year loss | (391.4) | (469.6) |

| 250-year loss | (541.4) | (570.1) |

| Hurricane US / Caribbean | ||

| 100-year loss | (850.3) | (772.7) |

| 250-year loss | (1,139.4) | (1,003.7) |

| Typhoon Japan | ||

| 100-year loss | (223.9) | (204.7) |

| 250-year loss | (281.9) | (265.1) |

| Earthquake Japan | ||

| 100-year loss | (363.1) | (343.7) |

| 250-year loss | (623.5) | (606.0) |

| Earthquake US West Coast | ||

| 100-year loss | (440.6) | (519.4) |

| 250-year loss | (795.4) | (823.2) |

| Earthquake Australia | ||

| 100-year loss | (201.0) | (202.8) |

| 250-year loss | (432.3) | (400.6) |

| 1 Converted to aggregate annual loss on grounds of consistency with the limit and threshold system for the natural catastrophe risk and the corresponding analyses (see tables Survival ratio in years and reserves for asbestos-related claims and pollution damage and Catastrophe losses and major claims in 2016) | ||

The previous approach (based on the maximum annual loss) was replaced in 2016 with an approach based on the aggregate annual loss. The figures for 2015 were recalculated retroactively using this approach. This changeover was motivated by the fact that our limit and threshold system for the natural catastrophe risk is geared to the aggregate annual loss and not individual losses. This is applicable both to the global and local risk measures and to the underwriting capacities. To this extent, the new approach is consistent with the approaches in natural catastrophe risk management and with the analysis of the required risk capital.

Within the scope of this process, the Executive Board defines the risk appetite for natural perils once a year on the basis of the risk strategy by specifying the portion of the economic capital that is available to cover risks from natural perils. This is a key basis for our underwriting approach in this segment. As part of our holistic approach to risk management across business groups, we take into account numerous relevant scenarios and extreme scenarios, determine their effect on portfolio and performance data, evaluate them in relation to the planned figures and identify alternative courses of action.

For the purposes of risk limitation, maximum amounts are also stipulated for various extreme loss scenarios and return periods in light of profitability criteria. Risk management ensures adherence to these maximum amounts. The Executive Board, Risk Committee and P & C Executive Committee are kept regularly updated on the degree of capacity utilisation. The limits and thresholds for the 200-year aggregate loss as well as the utilisation thereof are set out in the following table:

| Limit and threshold for the 200-year aggregate annual loss as well as utilisation thereof | |||

| in EUR million | Limit 2016 | Threshold 2016 | Actual utilisation (July 2016) |

|---|---|---|---|

| All natural catastrophe risks1 | |||

| 200-year aggregate annual loss | 1,827 | 1,645 | 1,519 |

| 1 Loss relative to the underwriting result | |||

Net expenditure on major losses in the year under review amounted to EUR 626.6 million (EUR 572.9 million). Our company incurred the following catastrophe losses and major claims in the 2016 financial year:

| Catastrophe losses and major claims 1 in 2016 | |||

| in EUR million | Date | gross | net |

|---|---|---|---|

| Forest fires, Canada | 30 April – 5 May 2016 | 190.8 | 127.9 |

| 4 marine claims | 124.6 | 66.5 | |

| 4 property claims | 116.0 | 97.3 | |

| Hurricane “Matthew”, Caribbean, United States | 3 – 8 October 2016 | 91.3 | 70.3 |

| Earthquake, New Zealand | 13 November 2016 | 85.2 | 56.3 |

| Earthquake, Ecuador | 16 – 17 April 2016 | 59.3 | 58.3 |

| 1 credit claim | 35.2 | 35.2 | |

| Earthquake, Japan | 14 April 2016 | 21.7 | 20.3 |

| Earthquake, Taiwan | 6 February 2016 | 21.6 | 19.2 |

| Storm “Elvira”, Germany, France | 27 – 28 May 2016 | 18.5 | 11.9 |

| Storms / hail, Netherlands, Germany | 22 – 23 June 2016 | 18.2 | 9.2 |

| Hail, Canada | 30 July 2016 | 15.1 | 9.1 |

| Severe weather / flooding, China | 1 June – 31 July 2016 | 13.2 | 13.2 |

| 1 aviation claim | 12.3 | 11.1 | |

| Typhoon “Meranti”, Taiwan, China | 13 – 14 September 2016 | 12.2 | 12.2 |

| Severe weather / hail, United States | 10 – 16 April 2016 | 11.4 | 8.4 |

| Total | 846.5 | 626.6 | |

| 1 Natural catastrophes and other major claims in excess of EUR 10 million gross | |||

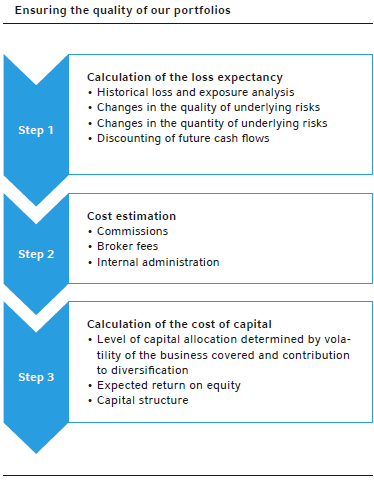

The price / premium risk lies primarily in the possibility of a random claims realisation that diverges from the claims expectancy on which the premium calculation was based. Regular and independent reviews of the models used for treaty quotation as well as central and local underwriting guidelines are vital management components. We have put in place a multi-step quotation process to ensure the quality of our portfolios:

In addition, Hannover Re’s regional and treaty departments prepare regular reports on the progress of their respective renewals. The reporting in this regard makes reference inter alia to significant changes in conditions, risks (such as inadequate premiums) as well as to emerging market opportunities and the strategy pursued in order to accomplish targets. The development of the combined ratio in property and casualty reinsurance in 2016 and prior years is shown in the table below:

| Combined and catastrophe loss ratio | ||||||||||

| in % | 2016 | 2015 | 2014 | 2013 | 2012 | 2011 | 2010 | 2009 | 2008 | 2007 |

|---|---|---|---|---|---|---|---|---|---|---|

| Combined ratio (property and casualty reinsurance) | 93.7 | 94.4 | 94.7 | 94.9 | 95.8 | 104.3 | 98.2 | 96.6 | 95.4 | 99.7 |

| Thereof catastrophe losses1 | 7.8 | 7.1 | 6.1 | 8.4 | 7.0 | 16.5 | 12.3 | 4.6 | 10.7 | 6.3 |

| 1 Net share of the Hannover Re Group for natural catastrophes and other major claims in excess of EUR 10 million gross as a percentage of net premium earned (until 31 December 2011: in excess of EUR 5 million gross) | ||||||||||

For further information on the run-off of the loss reserves please see our explanatory remarks in the section Run-off of the net loss reserve in the property and casualty reinsurance segment.