- Home

- Figures

- Foreword

- Executive Board

- Share

- Strategy

-

Management report

- Foundations of the Group

- Report on economic position

- Other success factors

-

Opportunity and risk report

-

Risk report

- Strategy implementation

- Major external factors

- Risk capital

- Risk management

- Risk management system

- Internal control system

- Risk landscape of Hannover Re

- Internal risk assessment

- Underwriting risks in property and casualty reinsurance

- Underwriting risks in life and health reinsurance

- Market risks

- Counterparty default risks

- Operational risks

- Other risks

- Opportunity report

-

Risk report

- Enterprise management

- Outlook

- Accounts

- Supervisory Board

- Sites

Organisation and processes of risk management

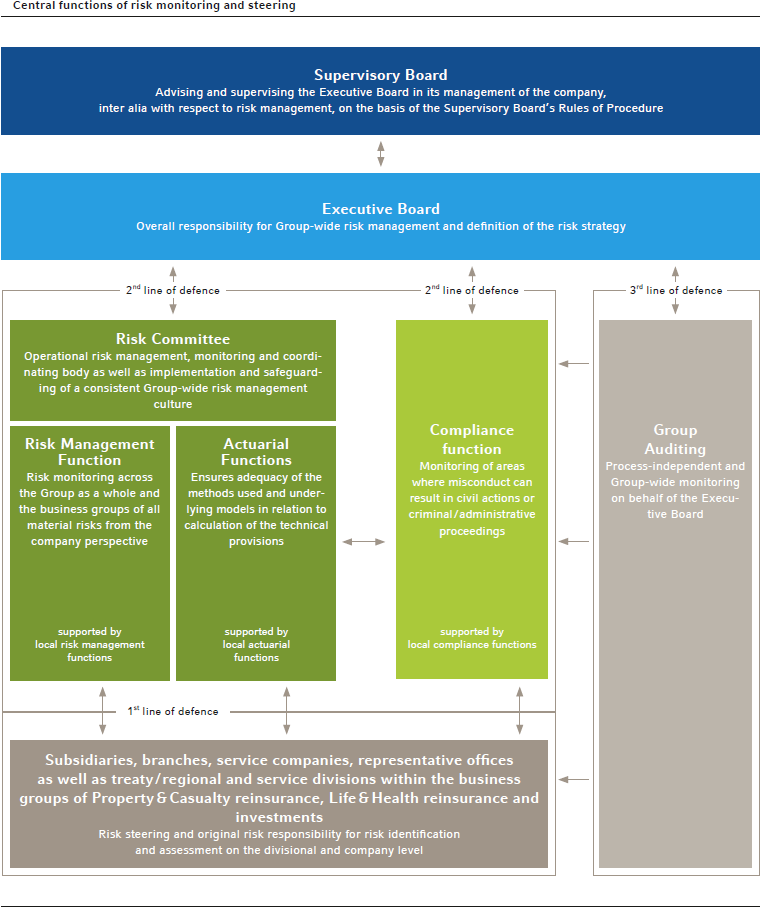

Hannover Re has set up risk management functions and bodies Group-wide to safeguard an efficient risk management system. The organisation and interplay of the individual functions in risk management are crucial to our internal risk steering and control system. The central functions of risk management are closely interlinked in our system and the roles, tasks and reporting channels are clearly defined and documented in terms of the so-called “3 lines of defence”. The first line of defence consists of risk steering and the original risk responsibility on the divisional or company level. Risk management ensures the second line of defence – risk monitoring. It is supported in this regard by the actuarial function and the compliance function. The third line of defence is the process-independent monitoring performed by the internal audit function. The following chart provides an overview of the central functions and bodies within the overall system as well as of their major tasks and powers.

Group-wide risk communication and an open risk culture are important to our risk management. Regular global meetings attended by the actuarial units and risk management functions serve as a major anchor point for strategic considerations in relation to risk communication.