- Home

- Figures

- Foreword

- Executive Board

- Share

- Strategy

-

Management report

- Foundations of the Group

- Report on economic position

- Other success factors

-

Opportunity and risk report

-

Risk report

- Strategy implementation

- Major external factors

- Risk capital

- Risk management

- Risk management system

- Internal control system

- Risk landscape of Hannover Re

- Internal risk assessment

- Underwriting risks in property and casualty reinsurance

- Underwriting risks in life and health reinsurance

- Market risks

- Counterparty default risks

- Operational risks

- Other risks

- Opportunity report

-

Risk report

- Enterprise management

- Outlook

- Accounts

- Supervisory Board

- Sites

Analysis of the consolidated cash flow statement

Liquidity

We generate liquidity primarily from our operational reinsurance business, investments and financing measures. Regular liquidity planning and a liquid investment structure ensure that Hannover Re is able to make the necessary payments at all times. Hannover Re’s cash flow is shown in the consolidated cash flow statement.

Hannover Re does not conduct any automated internal cash pooling within the Group. Liquidity surpluses are managed and created by the Group companies. Various loan relationships exist within the Hannover Re Group for the optimal structuring and flexible management of the short- or long-term allocation of liquidity and capital.

| Consolidated cash flow statement | ||

| in EUR million | 2016 | 20151 |

|---|---|---|

| Cash flow from operating activities | 2,331.3 | 3,104.9 |

| Cash flow from investing activities | (1,711.6) | (2,107.6) |

| Cash flow from financing activities | (626.9) | (1,054.8) |

| Exchange rate differences on cash | 34.9 | 24.0 |

| Change in cash and cash equivalents | 27.7 | (33.5) |

| Cash and cash equivalents at the beginning of the period | 821.0 | 854.5 |

| Change in cash and cash equivalents according to cash flow statement | 27.7 | (33.5) |

| Cash and cash equivalents at the end of the period | 848.7 | 821.0 |

| 1 Restated pursuant to IAS 8 (see section 3.1 of the notes “Changes in accounting policies”) | ||

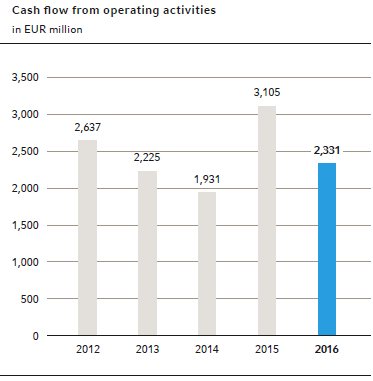

Cash flow from operating activities

The cash flow from operating activities, which also includes inflows from interest received and dividend receipts, amounted to EUR 2,331.3 million in the year under review as opposed to EUR 3,104.9 million in the previous year. The reduction of altogether EUR 773.6 million was essentially due to the payment of retrocession premiums for certain financial solutions contracts in life and health reinsurance, under which the corresponding premiums for assumption of the business had already been received in the previous year. The lower premium level was also a factor in the decreased cash flow from operating activities.

Cash flow from investing activities

The balance of cash inflows and outflows from operating activities and financing activities in an amount of EUR 1,711.6 million (EUR 2,107.6 million) was invested in accordance with the company’s investment policy, giving particular consideration to matching of currencies and maturities on the liabilities side of the technical account. Regarding the development of the investment portfolio please see also our remarks at the beginning of this section.

Cash flow from financing activities

The cash outflow from financing activities decreased from -EUR 1,054.8 million to -EUR 626.9 million in the year under review. The higher outflow in the previous year was mainly due to redemption of a EUR 500.0 million subordinated debt.

Overall, allowing for the restatements pursuant to IAS 8, the cash and cash equivalents therefore increased year-on-year by EUR 27.7 million to EUR 848.7 million.

For further information on our liquidity management please see the risk report.