- Home

- Figures

- Foreword

- Executive Board

- Share

-

Management report

- Foundations of the Group

- Report on economic position

-

Combined non-financial information statement

- Introduction

- Description of the business model

- Group and sustainability strategy

- Responsible corporate governance

- Compliance

- Risk management

- Stakeholder dialogue

- Risk expertise and risk assessment

- Sustainable insurance solutions

- ESG criteria in asset management

- Customer orientation and satisfaction

- Executive development / Employee advancement

- Employee retention

- Diversity

- Operational environmental protection

- Supplier management

-

Opportunity and risk report

-

Risk report

- Strategy implementation

- Major external factors

- Risk capital

- Risk management

- Risk management system

- Internal control system

- Risk landscape of Hannover Re

- Internal risk assessment

- Underwriting risks in property and casualty reinsurance

- Underwriting risks in life and health reinsurance

- Market risks

- Counterparty default risks

- Operational risks

- Other risks

- Opportunity report

-

Risk report

- Enterprise management

- Outlook

- Accounts

- Supervisory Board

- Sites

Life & Health reinsurance

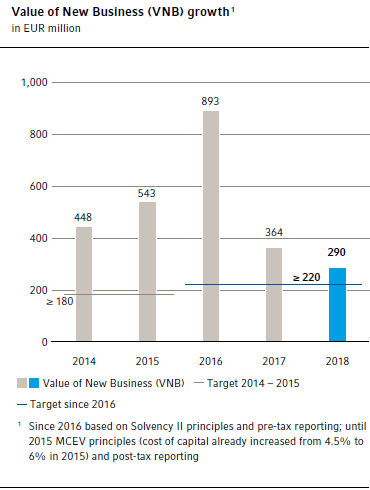

Life and health reinsurance contributed a substantial 38% share of Group gross premium in the year under review. Thanks to our global network and our know-how, we are able to drive both traditional business and new developments on the markets. We nevertheless consider the profitability and quality of the generated business to be the absolute overriding priority and we act accordingly.

Total business

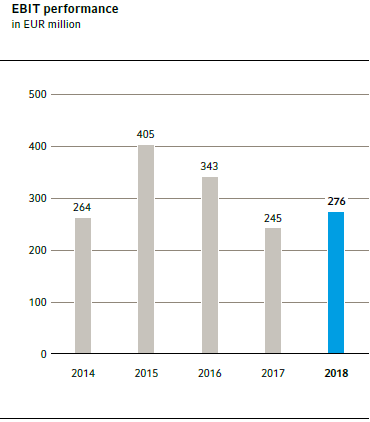

Numerus positive developments in our international life and health reinsurance portfolio helped us to achieve a solid result in the financial year just ended. Treaty recaptures prompted by our announcement of rate increases in legacy US mortality business gave rise to a charge to income of EUR 272.6 million. Allowing for the necessary release of an expense reserve in an amount of EUR 87 million, we achieved an operating result (EBIT) of EUR 275.9 million (previous year: EUR 245.2 million). This reflected the consistently good quality and solid profitability of the portfolio outside of the book of US mortality business acquired in 2009.

| Key figures for Life & Health reinsurance | ||||||

| in EUR million | 2018 | +/- previous year | 2017 | 2016 1 | 2015 | 2014 |

|---|---|---|---|---|---|---|

| Gross written premium | 7,200.4 | +1.7% | 7,079.6 | 7,149.0 | 7,730.9 | 6,458.7 |

| Net premium earned | 6,484.8 | +0.2% | 6,472.8 | 6,425.0 | 6,492.4 | 5,411.4 |

| Investment income | 491.8 | -12.3% | 560.6 | 638.9 | 709.2 | 614.2 |

| Claims and claims expenses | 5,341.6 | -5.7% | 5,666.8 | 5,480.3 | 5,459.0 | 4,636.2 |

| Change in benefit reserve | (50.8) | 0.6 | (83.0) | 101.1 | 28.6 | |

| Commissions | 1,263.6 | +16.8% | 1,081.8 | 1,020.4 | 1,075.1 | 946.4 |

| Own administrative expenses | 216.9 | +2.9% | 210.7 | 202.0 | 197.3 | 175.7 |

| Other income / expenses | 172.1 | +0.9% | 170.6 | 67.1 | 35.9 | 25.1 |

| Operating result (EBIT) | 275.9 | +12.5% | 245.2 | 343.3 | 405.1 | 263.8 |

| Net income after tax | 185.9 | +7.7% | 172.6 | 252.9 | 289.6 | 205.0 |

| Earnings per share in EUR | 1.54 | +7.7% | 1.43 | 2.10 | 2.40 | 1.70 |

| Retention | 90.7% | 91.7% | 90.4% | 84.2% | 83.9% | |

| EBIT margin 2 | 4.3% | 3.8% | 5.3% | 6.2% | 4.9% | |

1 Restated pursuant to IAS 8 2 Operating result (EBIT) / net premium earned |

||||||

The highlights of the reporting period included thoroughly pleasing new business growth in Asia and good results in large parts of Europe as well as the opening of our new Abidjan representative office in Côte d’Ivoire. We have laid the foundation for the future with this local presence, enabling us to work closely with our customers on the spot in a developing region that offers considerable promise.

Insurers in our domestic German market are increasingly preoccupied with the capital adequacy and solvency ratios prescribed by the European Solvency II Directive. Reinsurance covers offer one possible solution for meeting the required ratios. Demand for reinsurance solutions was, however, more subdued in the year under review owing to transitional measures that allow insurers to satisfy reduced requirements for a certain period of time.

From a global perspective, we saw strong demand for reinsurance solutions to cover longevity risks – driven in part by the exacting capital requirements for such business on the primary insurance side. New business avenues also opened up to us through digitalisation initiatives and insurtechs. In most cases these are small start-up enterprises that are normally reliant on cooperations with experienced, cash-rich partners. By partnering with insurtechs we also generate benefits for primary insurers and policyholders. Through this type of partnership we are able to help our customers respond to the changing needs of policyholders and bring innovations to market.

The total gross premium income booked in life and health reinsurance for the year under review amounted to EUR 7,200.4 million (EUR 7,079.6 million). This is equivalent to modest growth of 1.7%; the increase would have been 4.6% at constant exchange rates, which was in line with our expectations. The level of retained premium stood at 90.7% (91.7%). Net premium earned was stable at EUR 6,484.8 million (EUR 6,472.8 million), corresponding to growth of 3.2% adjusted for exchange rate effects.

In view of the unchanged low level of interest rates, investment income in life and health reinsurance contracted as expected and totalled EUR 491.8 million (EUR 560.6 million). The share of the income attributable to our assets under own management amounted to EUR 319.6 million (EUR 343.5 million), while the contribution made by income from securities deposited with ceding companies came in at EUR 172.2 million (EUR 217.1 million).

The operating result (EBIT) reached EUR 275.9 million (EUR 245.2 million). Bearing in mind the charge to income associated with the aforementioned recaptures in legacy US mortality business, this is a pleasing performance. Group Net income for life and health reinsurance improved by 7.7% to EUR 185.9 million (EUR 172.6 million).

We provide below a more detailed discussion of developments in the individual reporting categories of “Financial Solutions”, “Longevity Solutions” and “Mortality and Morbidity Solutions” as well as an overview of our extensive range of services under the heading “Underwriting Services”.

Financial Solutions

In our financial solutions business we concentrate on reinsurance solutions geared to optimising the solvency, liquidity and capital position of our customers. These forms of reinsurance are highly diverse and individually structured because they are always tailored to the customer’s needs. The decisive differentiating feature is that the customer’s primary motivation is not exclusively the coverage of biometric risks, but rather the protection of its financial and balance sheet position. We can draw on decades of global expertise in this field.

The US has long been an extremely important insurance market for us in this segment. Our financial solutions business performed superbly here and once again delivered a clearly positive contribution to the total result for the reporting category.

Primary insurers in Germany showed considerable interest in Solvency II issues, as they had in the previous year. While the minimal capital adequacy ratios required by the regulator (BaFin) were met by the companies across the board, the ratios varied sometimes markedly. Applying our expertise to the elaboration of possible solutions, we stand ready to support our customers as a reliable partner and we were able to successfully place corresponding business.

Demand for financing solutions to help fund the additional interest rate reserve (“Zinszusatzreserve”) eased somewhat. The reserve requirements were softened through regulatory adjustments, as a consequence of which primary insurers were not under quite as much pressure as they had been in the previous year.

In general terms, considerable activity could be observed in the area of financial solutions on various European markets. In addition to Germany, we were successful in generating new business in Western and Central Europe and implemented financing solutions for a range of customers. Interest in reinsurance solutions with a bearing on Solvency II was also evident in the Scandinavian markets. This significance attached to this subject has increased in these markets, too, and we are engaging individual customers in an active dialogue.

Customers in Asia – especially China – showed a lively interest in the area of financial solutions and we were thoroughly successful in writing such business. Gross premium income from financial solutions rose by 3.7% to EUR 928.2 million (EUR 895.1 million). The written premium corresponds to 12.9% of the total gross premium booked in life and health reinsurance. Furthermore, financial solutions delivered another appreciable EBIT contribution from contracts with a reduced risk transfer, with income of EUR 197.0 million being recognised in other income / expenses. The operating result (EBIT) came in at a very pleasing EUR 319.4 million (EUR 223.8 million).

Longevity Solutions

In the longevity solutions reporting category we group together all reinsurance business where the primary risk covered is the longevity risk. We develop innovative annuity products tailored to the individual needs of policyholders in various life situations. The bulk of the business in this category consists of traditional annuity policies, pensions blocks taken out for new business and enhanced annuities – under which pensioners with a pre-existing condition are guaranteed a higher annuity payment for their remaining shortened life expectancy.

International demand for longevity solutions in the financial year was again sharply up on previous years. Interest in our tailor-made product solutions is no longer restricted just to our former core markets such as the United Kingdom and the Netherlands, but rather it spans the globe – with a focus on Canada, Asia, Australia and South Africa. Through these activities we are also able to play a part in the fight against poverty in old age, which is a major problem in some of these regions.

In Australia, for example, longevity was a dominant topic on the market following a change to retirement provision due to a regulatory adjustment. This compelled insurers to take action in relation to existing covers, hence opening up new business potential both for ourselves and our customers.

Another factor in the increased demand worldwide was the exacting solvency-based capital requirements imposed on insurers under the various local prudential regimes. Where longevity risks are involved, primary insurers need to hold very high reserves as collateral for pension commitments that are often still in the distant future. In some instances financial solutions arrangements can also be considered here, as discussed above.

The United Kingdom continues to be our largest and most mature market for longevity solutions. Minimal mortality improvements on the market could be discerned (provisionally) during the reporting period. On the one hand, this had positive implications for our existing book of longevity business. On the other hand, it also led to considerably more capacity in the longevity market and the associated pressure on prices. We have made a conscious choice not to follow this price trend at the present time, but instead only write selected risks.

In total, the gross premium for longevity business increased in the year under review by 1.5% to EUR 1,276.1 million (EUR 1,256.9 million). The operating result (EBIT) reached a level of EUR 5.6 million (EUR 20.0 million).

Mortality and Morbidity Solutions

In the global (re)insurance industry it is standard practice for mortality and morbidity risks to form a common element of one and the same business relationship, and in some cases both risks are even covered under one reinsurance treaty. In our reporting we therefore consolidate the profit contributions of these two reporting categories and provide below merely an overview of significant developments in the past year affecting our mortality and morbidity business.

Mortality Solutions

Mortality-exposed business forms the core of traditional life and health reinsurance and, in terms of premium volume, still accounts for the bulk of our total premium income in this business group. The business discussed in this reporting category consists of covers that protect our customers against the risk that people do not live as long as anticipated and hence the actual mortality negatively diverges from the originally expected mortality.

The most significant impact on the result for this reporting category in the financial year just ended derived from part of our legacy US mortality portfolio that we had acquired in 2009. In view of past experience we initiated rate increases for the relevant treaties in the second quarter of 2018. This prompted treaty recaptures on the part of the ceding companies. The total loss recognised in the balance sheet in this connection added up to EUR 273 million or USD 322 million. We are consciously willing to accept these losses because further strains on the corresponding treaties in subsequent years can be largely avoided. For 2019 we already expect to see an appreciable improvement in the result – in part also because new US mortality business written in the reporting period delivered a pleasing profit contribution.

Markets in Europe similarly showed dynamic growth. In Western and Central Europe we acquired new customers and were successful in generating new business. In Italy and Spain, for example, we enjoyed a robust business development throughout the reporting period and achieved a healthy profit contribution. Market competition was noticeably more intense in northern parts of Europe, especially in Sweden. Despite this, our business here lived up to our expectations.

The market in Australia was already undergoing a period of consolidation as large Australian banks have either sold their life insurance subsidiaries or are currently trying to do so. The banks are focusing on their core business which, in their assessment, offers the potential for higher margins than their insurance activities. It is evident that international players are usually the ones buying stakes in these life insurance operations and hence more and more Australian insurers are coming under foreign ownership. As a reinsurer, we are closely monitoring the ongoing developments and we are talking both to our own customers and new market entrants.

Gross premium for mortality business contracted by 5.0% to EUR 3,039.5 million (EUR 3,200.1 million). Altogether, it contributed 42.2% of the total gross premium income booked in life and health reinsurance (EUR 7.2 billion).

Morbidity Solutions

Within the morbidity solutions reporting category, we cover business centred around the risk of deterioration in a person’s state of health due to disease, injury or infirmity. A hallmark of this business is the wide range of possible combinations of different covered risks, including for example strict (any occupation) disability, occupational disability and various forms of long-term care insurance. A dedicated team of staff equipped with both specialist expertise and access to our network of business centres stands ready to assist with transactions of this type. In this way, our customers are able to optimally benefit from our global know-how on a local basis.

Mature markets were increasingly preoccupied with the issue of long-term care (insurance) in old age. In Germany, for example, we have consistently expanded our range of solutions as part of an ongoing dialogue with our customers.

In the countries of Central and Eastern Europe, too, a greater awareness of life situations with critical health implications could be discerned in the reporting period just ended. In addition to the coverage offered by state-run schemes, the level of which is still inadequate, it is becoming increasingly important to have sufficient private provision. Consequently, it was evident that our customers generally showed stronger interest in critical illness products and health insurance coverage.

In the United States we continued to build on our leading position in the ACO (Accountable Care Organization) market. ACOs are groups of healthcare providers who come together voluntarily to give coordinated high-quality care to their patients. The goal is to ensure that patients – especially those with chronic diseases – get the best possible care at the right time through appropriate treatment. We have been a reliable partner of ACOs for some years now and provide actuarial and risk-related support for these organisations, which are managed exclusively by healthcare providers such as doctors and hospitals. From an overall perspective, our health and special risk business in the US developed as anticipated and delivered a healthy profit contribution.

In Australia we observed a market-wide deterioration in individual occupational disability business. The higher-than-expected losses adversely affected our result – in common with that of other market players – in this reporting category.

In Asia, on the other hand, our morbidity business fared exceptionally well. The Chinese market showed the most dynamic growth in the year under review. Most notably, we were able to substantially grow our critical illness business because, among other things, the Chinese regulator is encouraging more active marketing of these solutions. Along with the traditional critical illness product, modifications in the form of additional risk inclusions were also widely used. In China, alone, we consequently acquired numerous new customers and treaties, with appreciable positive effects on the premium volume. Our business in the other Asian markets developed largely in line with our expectations.

Gross premium for morbidity business grew by 13.3% in the financial year just ended to EUR 1,956.5 million (EUR 1,727.5 million).

Gross premium for our total mortality and morbidity solutions business increased by 1.4% to EUR 4,996.0 million (EUR 4,927.6 million). The operating result (EBIT) for the two reporting categories came in at EUR -49.1 million (EUR 1.4 million).

Underwriting Services

Under the heading of Underwriting Services we report on the activities and services that we perform for our customers above and beyond pure risk transfer. Our automated underwriting systems and the associated process automation for our customers are a major feature in this regard. In the year under review it was again evident that these services constitute a key competitive advantage and cement our business relationships with our customers. Furthermore, our automated underwriting systems help our customers to structure the underwriting process more efficiently, expand their product range and hence respond to the needs of individual policyholders in an optimal and timely manner.

Digitalisation, innovation and automation have significantly influenced the entire insurance industry around the world. This trend, which was already clearly evident in the previous reporting period, continued to shape the 2018 financial year.

Our expectations for the development and take-up rate of our underwriting systems were far exceeded. Most importantly, the consistently positive feedback received from our customers confirms that we have found the right concept for translating our experience into a future-ready and appropriately tailored solution. The combination of a state-of-the-art and flexibly customisable underwriting system that efficiently organises the application process with a comprehensive range of support and other services is seen as a clear win in the eyes of our customers.

We are currently in talks regarding our underwriting system hr|Quirc not only with customers in Africa and the Middle East but also with an increasing number of Asian insurance providers, who have signalled their interest in implementation.

Similarly, we were thoroughly satisfied with the progressive global roll-out of our state-of-the-art and flexibly customisable system hr|ReFlex in the reporting period. Along with the implementations already completed in prior years, we were again successful in launching hr|ReFlex with a large number of existing and new customers in the year under review.

In the context of the complex range of issues relating to digitalisation and innovation, we have increasingly engaged in a dialogue with start-ups specialising in insurance solutions – frequently in the form of (online) platforms. The trend towards policyholders tracking and systematically evaluating their health with the aid of wearables – small, smart electronic devices worn on the body – is no longer a new one. Quite the contrary, an attractive market has grown up around digital wellness – one in which we, too, are seeking to get actively involved. Working with our cooperation partners, we offer insurance products geared to a healthy and responsible lifestyle. These products enable insurers to combine broad-ranging technical solutions for health-conscious consumers with an innovative, digital experience while at the same time providing insurance coverage. The blend of our long-standing worldwide underwriting expertise and technical innovation opens up new possibilities in risk analysis, product design and health management.

In the United States, for example, we worked together with a US insurtech on the successful implementation of our underwriting system hr|ReFlex. Our cooperation partner uses online and mobile channels to sell life insurance directly to end consumers. This was a first for the US life insurance market. Sales were expanded to virtually all US states in the year under review. This innovative combination of online sales with our underwriting system hr|ReFlex delivers a cost-efficient and flexible solution for end consumer and provider alike. Initial results indicate that this solution has been well received by policyholders.

In the French market, too, a change in the law drove the need for innovation in the credit life sector. We support primary insurance partners by reinsuring a newly launched form of credit life insurance that rewards a healthy active lifestyle. Preferential rates are available to insureds who follow a defined but basic programme of sports activities.

All in all, the focus of all our activities – taking into consideration our corporate objectives – is on the needs of our customers. We aspire to be a reliable expert partner over the long term in every situation and for the widest possible range of concerns. Along with traditional reinsurance solutions, this means keeping a close eye on new products and developing concepts designed to satisfy supervisory requirements. Not only that, we must move with the times and keep pace with the trend towards increasing innovation and more technology, and we must also be willing to take on capital market risks. With minority interests in two companies specialising in the transfer of capital market risks, we have expanded our range of solutions and ensured that we can also meet this need on the part of primary insurers.