- Home

- Figures

- Foreword

- Executive Board

- Share

-

Management report

- Foundations of the Group

- Report on economic position

-

Combined non-financial information statement

- Introduction

- Description of the business model

- Group and sustainability strategy

- Responsible corporate governance

- Compliance

- Risk management

- Stakeholder dialogue

- Risk expertise and risk assessment

- Sustainable insurance solutions

- ESG criteria in asset management

- Customer orientation and satisfaction

- Executive development / Employee advancement

- Employee retention

- Diversity

- Operational environmental protection

- Supplier management

-

Opportunity and risk report

-

Risk report

- Strategy implementation

- Major external factors

- Risk capital

- Risk management

- Risk management system

- Internal control system

- Risk landscape of Hannover Re

- Internal risk assessment

- Underwriting risks in property and casualty reinsurance

- Underwriting risks in life and health reinsurance

- Market risks

- Counterparty default risks

- Operational risks

- Other risks

- Opportunity report

-

Risk report

- Enterprise management

- Outlook

- Accounts

- Supervisory Board

- Sites

Market risks

Faced with a challenging capital market climate, particularly high importance attaches to preserving the value of assets under own management and the stability of the return. Hannover Re’s portfolio is therefore guided by the principles of a balanced risk / return profile and broad diversification. Based on a risk-averse asset mix, the investments reflect both the currencies and durations of our liabilities. Market price risks include equity risks, interest rate risks, foreign exchange risks, real estate risks, default and spread risks. Our portfolio currently consists in large part of fixed-income securities, and hence default and spread risks account for the bulk of the market risk. We minimise interest rate and foreign exchange risks through the greatest possible matching of payments from fixed-income securities with the projected future payment obligations from our insurance contracts. Market risks derive from the investments managed by Hannover Re itself and from investment risks of ceding companies that we assume in connection with insurance contracts. The following table shows the risk capital with a confidence level of 99.5% for the market risks from investments under own and third-party management.

| Required risk capital 1 for market risks | |||||

| in EUR million | 31.12.2018 | 31.12.2017 | |||

|---|---|---|---|---|---|

| Default and spread risk | 2,689.3 | 2,403.2 | |||

| Interest rate risk | 711.6 | 1,038.4 | |||

| Foreign exchange risk | 1,177.9 | 901.1 | |||

| Equity risk2 | 932.3 | 820.6 | |||

| Real estate risk | 608.9 | 549.5 | |||

| Diversification | (2,286.5) | (2,250.6) | |||

| Market risk | 3,833.5 | 3,462.2 | |||

| 1 Required risk capital at a confidence level of 99.5% 2 Including private equity | |||||

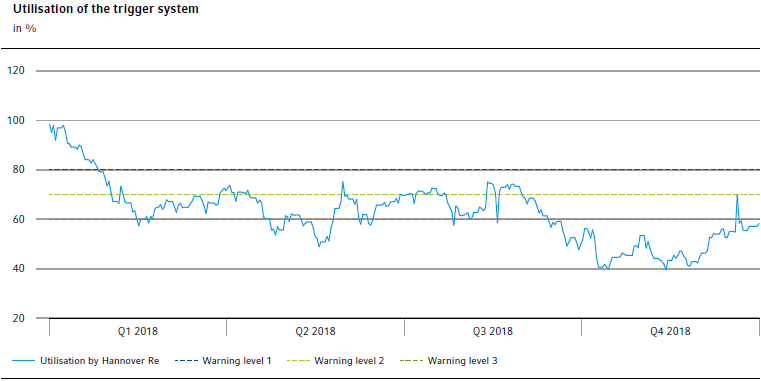

With a view to preserving the value of our assets under own management, we constantly monitor adherence to a trigger mechanism based on a clearly defined traffic light system that is applied across all portfolios. This system defines clear thresholds and escalation channels for the cumulative fluctuations in fair value and realised gains / losses on investments since the beginning of the year. These are unambiguously defined in conformity with our risk appetite and trigger specified information and escalation channels if a corresponding fair value development is overstepped.

Interest rate and spread markets were relatively volatile over the course of the year under review. Needless to say, our conservatively oriented investment portfolio was not left unaffected by these market movements. While EUR interest rates were rather stable on a low level, USD and GBP interest rates recorded appreciable increases and risk premiums on corporate bonds fluctuated sharply during the year before settling for the most part on a substantially higher level at year-end than at the beginning of the reporting period. A significant decrease – albeit one in line with our planning – was thus booked in the hidden reserves for fixed-income securities over the year as a whole.

The predefined discussion and analysis mechanisms in connection with a triggering of the early-warning system’s escalation levels reached the assessment in each case that the general market movements would not have any intolerable or strategy-altering implications for our portfolio or our economic capitalisation. For this reason, our trigger system did not cause us to make any changes to the asset allocation in the reporting period.

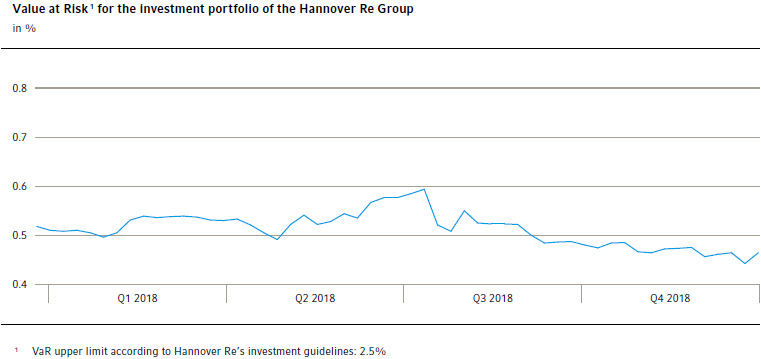

The short-term loss probability measured as the Value at Risk (VaR) is another vital tool used for operational monitoring and management of the market price risks associated with our securities positions. It is calculated on the basis of historical data, e. g. the volatility of the securities positions under own management and the correlation between these risks. As part of these calculations the decline in the fair value of our securities portfolio is simulated with a certain probability and within a certain period. The VaR of the Hannover Re Group determined in accordance with these principles specifies the decrease in the fair value of our securities portfolio under own management that with a probability of 95% will not be exceeded within ten trading days. A standard market model is used to calculate the VaR indicators for the Hannover Re Group; the risk model used in the previous reporting period was replaced with a more state-of-the-art variant in the year under review as part of our continuous efforts to strengthen our risk models. It is based on historical time series of relevant market parameters (equity prices, yield curves, spread curves and exchange rates). Against the backdrop of what was still a difficult capital market and interest rate environment, volatilities – especially of fixed-income assets – were again on a high level in the year under review. Based on continued broad risk diversification and the orientation of our investment portfolio, our VaR was nevertheless clearly below the VaR upper limit defined in our investment guidelines. It amounted to 0.5% (previous year: adjusted 0.5%) as at the end of the reporting period.

Stress tests are conducted in order to be able to map extreme scenarios as well as normal market scenarios for the purpose of calculating the Value at Risk. In this context, the loss potentials for fair values and shareholders’ equity (before tax) are simulated on the basis of already occurred or notional extreme events.

| Scenarios for changes in the fair value of material asset classes | |||||

| in EUR million | Scenario | Portfolio change on a fair value basis | Change in equity before tax | ||

|---|---|---|---|---|---|

| Equity securities and private equity | Share prices -10% | -92.6 | -92.6 | ||

| Share prices -20% | -185.2 | -185.2 | |||

| Share prices + 10% | +92.6 | +92.6 | |||

| Share prices + 20% | +185.2 | +185.2 | |||

| Fixed-income securities | Yield increase + 50 basis points | -906.4 | -836.5 | ||

| Yield increase + 100 basis points | -1,769.2 | -1,632.2 | |||

| Yield decrease -50 basis points | +954.5 | +881.5 | |||

| Yield decrease -100 basis points | +1,961.6 | +1,812.3 | |||

| Real estate | Real estate market values -10% | -239.2 | -99.0 | ||

| Real estate market values + 10% | +239.2 | +44.6 | |||

Further significant risk management tools – along with the various stress tests used to estimate the loss potential under extreme market conditions – include sensitivity and duration analyses and our asset / liability management (ALM). The internal capital model provides us with quantitative support for the investment strategy as well as a broad diversity of VaR calculations. In addition, tactical duration ranges are in place, within which the portfolio can be positioned opportunistically according to market expectations. The parameters for these ranges are directly linked to our calculated risk-bearing capacity. It should be borne in mind that the issued subordinated bonds and resulting induced interest rate exposure are actively factored into our ALM. Further information on the risk concentrations of our investments can be obtained from the tables on the rating structure of fixed-income securities as well as on the currencies in which investments are held.

Equity risks derive from the possibility of unfavourable changes in the value of equities, equity derivatives or equity index derivatives in our portfolio. Their relevance to our investments decreased sharply in the year under review, however, because we liquidated our holdings of non-strategic listed equities and equity funds at the end of the previous year. This leaves only a minimal portfolio in the context of strategic holdings. Our exposure to the private equity market remains unchanged. Changes in fair value here tend to be prompted less by general market conditions and more by entity-specific assessments. The risks are associated principally with the business model and profitability and less so with the interest rate component in the consideration of cash flow forecasts.

The portfolio of fixed-income securities is exposed to the interest rate risk. Declining market yields lead to increases and rising market yields to decreases in the fair value of the fixed-income securities portfolio. The credit spread risk should also be mentioned. The credit spread refers to the interest rate differential between a risk-entailing bond and risk-free bond with the same maturity. Changes in these risk premiums, which are observable on the market, result – analogously to changes in pure market yields – in changes in the fair values of the corresponding securities. We minimise interest rate risks by matching the durations of payments from fixed-income securities as closely as possible with the projected future payment obligations under our insurance contracts.

Foreign exchange risks are especially relevant if there is a currency imbalance between the technical liabilities and the assets. Through extensive matching of currency distributions on the assets and liabilities side, we reduce this risk on the basis of the individual balance sheets within the Group. The short-term Value at Risk therefore does not include quantification of the foreign exchange risks. We regularly compare the liabilities per currency with the covering assets and optimise the currency coverage by regrouping assets. In so doing, we make allowance for collateral conditions such as different accounting requirements. Remaining currency surpluses are systematically quantified and monitored within the scope of economic modelling. A detailed presentation of the currency spread of our investments is provided in section 6.1 “Investments under own management”.

Real estate risks result from the possibility of unfavourable changes in the value of real estate held either directly or through fund units. They may be caused by a deterioration in particular qualities of a property or by a general downslide in market values. Real estate risks continued to grow in importance for our portfolio owing to our ongoing involvement in this sector. We spread these risks through broadly diversified investments in high-quality markets worldwide; each investment is preceded by detailed analyses of the property, manager and market concerned.

We use derivative financial instruments only to the extent needed to hedge risks. The primary purpose of such financial instruments is to hedge against potentially adverse developments on capital markets. A portion of our cash flows from the insurance business as well as foreign exchange risks arising because currency matching cannot be efficiently achieved are hedged to some extent using forward exchange transactions. Hannover Re holds further derivative financial instruments to hedge interest rate risks from loans taken out to finance real estate. In addition, Hannover Re holds hedges in the form of equity swaps to hedge price risks in connection with the stock appreciation rights granted under the Share Award Plan. These are intended to neutralise changes in the fair values of the awarded stock appreciation rights. Contracts are concluded with reliable counterparties and for the most part collateralised on a daily basis so as to avoid credit risks associated with the use of such transactions. The remaining exposures are controlled according to the restrictive parameters set out in our investment guidelines.

Derivatives connected with the technical account play a minor role in Hannover Re’s portfolio.

Our investments entail credit risks that arise out of the risk of a failure to pay (interest and / or capital repayment) or a change in the credit status (rating downgrade) of issuers of securities. We attach equally vital importance to exceptionally broad diversification as we do to credit assessment conducted on the basis of the quality criteria set out in the investment guidelines. We measure credit risks in the first place using the standard market credit risk components, especially the probability of default and the potential amount of loss – making allowance for any collateral and the ranking of the individual instruments depending on their effect in each case.

We then assess the credit risk first on the level of individual securities (issues) and in subsequent steps on a combined basis on the issuer level. In order to limit the risk of counterparty default we set various limits on the issuer and issue level as well as in the form of dedicated rating quotas. A comprehensive system of risk reporting ensures timely reporting to the functions entrusted with risk management.

| Rating structure of our fixed-income securities1 | ||||||||

| Rating classes | Government bonds | Securities issued by semi-governmental entities2 | Corporate bonds | Covered bonds / asset-backed securities | ||||

|---|---|---|---|---|---|---|---|---|

| in % | in EUR million | in % | in EUR million | in % | in EUR million | in % | in EUR million | |

| AAA | 77.0 | 11,517.6 | 60.8 | 4,031.7 | 1.2 | 141.1 | 60.9 | 1,844.0 |

| AA | 13.0 | 1,935.2 | 25.1 | 1,665.0 | 13.7 | 1,628.1 | 23.8 | 722.5 |

| A | 5.4 | 800.8 | 6.1 | 407.1 | 30.1 | 3,564.2 | 10.9 | 331.4 |

| BBB | 2.7 | 401.3 | 1.2 | 77.6 | 46.5 | 5,503.6 | 3.4 | 103.0 |

| < BBB | 1.9 | 278.0 | 6.8 | 453.4 | 8.5 | 1,012.7 | 1.0 | 30.1 |

| Total | 100.0 | 14,932.8 | 100.0 | 6,634.8 | 100.0 | 11,849.7 | 100.0 | 3,031.0 |

| 1 Securities held through investment funds are recognised pro rata with their corresponding individual ratings. 2 Including government-guaranteed corporate bonds | ||||||||

In general terms, Hannover Re gears its investment portfolio to the principles of a balanced risk / return ratio coupled with broad diversification. Accordingly, we counter the risk concentrations that nevertheless arise in individual asset classes with the broadest possible spread of different issuers per asset class. This is just as much a key component of our investment policy as credit rating assessment and management based on the quality criteria defined in the investment guidelines.

On a fair value basis EUR 4,126.2 million of the corporate bonds held by our company were issued by entities in the financial sector. Of this amount, EUR 3,285.4 million was attributable to banks. The vast majority of these bank bonds (65.7%) are rated “A” or better. Our investment portfolio under own management does not contain any written or issued credit default swaps.