Property & Casualty reinsurance

| Key figures for Property & Casualty reinsurance | ||||||

|---|---|---|---|---|---|---|

| in EUR million | 2015 | +/– previous year |

2014 | 2013 | 20121 | 2011 |

| Gross written premium | 9,338.0 | +18.2% | 7,903.4 | 7,817.9 | 7,717.5 | 6,825.5 |

| Net premium earned | 8,099.7 | +15.5% | 7,011.3 | 6,866.3 | 6,854.0 | 5,960.8 |

| Underwriting result | 432.2 | +23.0% | 351.5 | 335.5 | 272.2 | (268.7) |

| Net investment income | 945.0 | +12.0% | 843.6 | 781.2 | 944.5 | 845.4 |

| Operating result (EBIT) | 1,341.3 | +12.6% | 1,190.8 | 1,061.0 | 1,091.4 | 599.3 |

| Group net income | 914.7 | +10.3% | 829.1 | 807.7 | 685.6 | 455.6 |

| Earnings per share in EUR | 7.58 | +10.3% | 6.88 | 6.70 | 5.68 | 3.78 |

| EBIT margin2 | 16.6% | 17.0% | 15.5% | 15.9% | 10.1% | |

| Retention | 89.3% | 90.6% | 89.9% | 90.2% | 91.3% | |

| Combined ratio3 | 94.4% | 94.7% | 94.9% | 95.8% | 104.3% | |

| 1 Adjusted pursuant to IAS 8 2 Operating result (EBIT)/net premium earned 3 Including expenses on funds withheld and contract deposits |

||||||

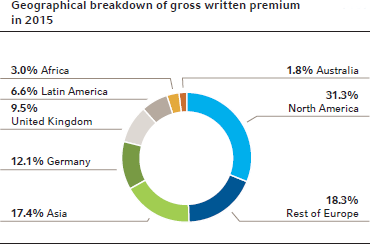

Accounting for 55% of our premium volume, Property & Casualty reinsurance is Hannover Re’s largest business group. It is structured according to our Board areas of responsibility, namely “Target markets”, “Specialty lines worldwide” and “Global reinsurance”.

Property and casualty reinsurance once again proved to be intensely competitive in the 2015 financial year. In the absence of market-changing losses, ceding companies continue to enjoy strong capital resources, prompting some of our clients to pass on fewer risks to the reinsurance market. On the other hand, we noted increased demand for additional reinsurance coverage. As a further factor, the inflow of capital from the market for catastrophe bonds (ILS) – especially in US natural catastrophe business – added to the premium erosion. As the year progressed, however, a reduction in the oversupply of reinsurance capacity could be discerned relative to the previous year. Most significantly, the resurgent US economy sent out positive signals for the premium trend in mature markets.

Based on our profit-oriented underwriting policy, we are well placed to handle the challenging market conditions. It remains the case that we expand our portfolio only in areas where margins are commensurate with the risks. In regions and lines where prices fail to satisfy our profitability requirements, however, we systematically reduce our shares. This strategy of active cycle management enables us – despite soft market conditions – to largely preserve the high rate quality of our portfolio.

We are broadly satisfied with the outcome of the various rounds of treaty renewals during the year under review. The largest business volume is traditionally renewed on 1 January, the date in 2015 when almost two-thirds of our treaties were renegotiated. While rate reductions and in some instances deteriorations in conditions were observed in many markets, it was also possible to obtain rate increases under treaties that had been impacted by losses in 2014. This was especially true of our domestic German market. Rates in the aviation line developed less favourably despite significant losses. Rate movements were still limited on account of the continued abundant availability of insurance capacity, prompting us to scale back our premium volume in this line. All in all, our portfolio remained stable.

By and large, this trend was sustained in the treaty renewals during the year, although isolated indications of a stabilisation in reinsurance prices could be detected. With this in mind, we were also satisfied with the renewals as at 1 June and 1 July 2015 – the dates when, most notably, parts of our North American portfolio, agricultural risks and business from Latin America come up for renewal. Hannover Re successfully grew its business at adequate rates. This was also the main renewal season for business in Australia, which passed off highly successfully for Hannover Re thanks to the enlarged market share secured with long-standing customers.

All in all, Hannover Re once again benefited in the year under review from its enduring customer relationships as well as its position as one of the leading and most financially robust reinsurance groups in the world.

Against this backdrop, the total gross premium in the year under review climbed by a substantial 18.2% to EUR 9.3 billion (previous year: EUR 7.9 billion); at constant exchange rates growth would have reached 8.1%. We thus beat our guidance, which had anticipated a stable currency-adjusted premium volume. The level of retained premium decreased to 89.3% (90.6%). Net premium earned increased by 15.5% to EUR 8.1 billion (EUR 7.0 billion); growth would have been 6.4% at constant exchange rates.

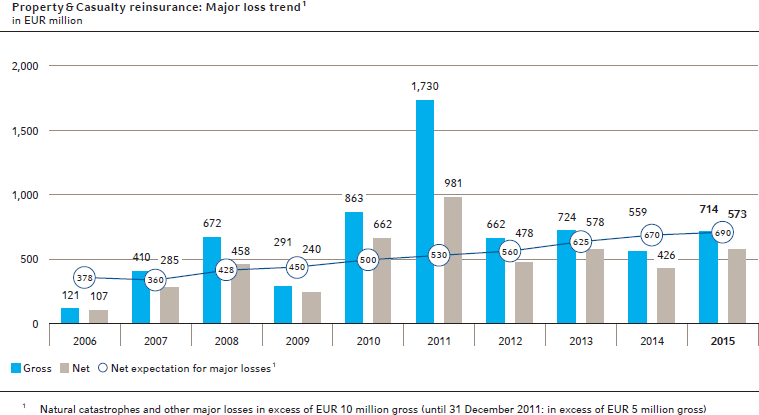

As in the previous years, the burden of major losses that we incurred remained moderate: the hurricane season in North America and the Caribbean once again passed off thoroughly unremarkably in 2015. However, an increased number of natural disasters was recorded, including for example flooding in the UK and the storm “Niklas” in Europe. There was also a spate of man-made losses. The largest single loss for the insurance industry and hence also for our company was the devastating series of explosions at the port of the Chinese city of Tianjin in August 2015. This gave rise to loss expenditure of EUR 111.1 million for our net account.

These and other large losses resulted in net major loss expenditure for our company totalling EUR 572.9 million (EUR 425.7 million). While this figure is well above that of the previous year, it still came in below our budgeted level of EUR 690 million. For a detailed list of our catastrophe and large losses please see here.

The combined ratio of 94.4% (94.7%) in the year under review was better than the target mark of 96%. The underwriting result (including expenses on funds withheld and contract deposits) improved again on the previous year to reach EUR 452.4 million (EUR 371.9 million).

Investment income in property and casualty reinsurance climbed by a pleasing 12.0% to EUR 945.0 million (EUR 843.6 million). The operating profit (EBIT) reached a new record level in the year under review of EUR 1,341.3 million (EUR 1,190.8 million), equivalent to growth of 12.6%. The EBIT margin stood at 16.6% (17.0%) and thus comfortably surpassed our minimum target of 10%. Group net income improved by 10.3% to EUR 914.7 million (EUR 829.1 million). Earnings per share stood at EUR 7.58 (EUR 6.88) for this business group.

On the following pages we report in detail on developments in the individual markets and lines of our Property & Casualty reinsurance group, split into the three areas of Board responsibility referred to at the beginning of this section.

| Property & Casualty reinsurance: Key figures for individual markets and lines in 2015 | ||||||

|---|---|---|---|---|---|---|

| Gross premium 2015 in EUR million | Change in gross premium relative to previous year | Gross premium 2014 in EUR million | EBIT in | Combined ratio | Maximum tolerable combined ratio (MtCR) | |

| Target markets | 2,925.5 | +11.7% | 2,619.4 | 445.2 | 99.0% | 96.5% |

| North America | 1,493.8 | +23.1% | 1,213.4 | 242.0 | 99.6% | 99.2% |

| Continental Europe | 1,431.7 | +1.8% | 1,406.1 | 203.2 | 98.4% | 94.4% |

| Specialty lines worldwide | 2,920.4 | +13.4% | 2,575.6 | 518.5 | 90.9% | 97.5% |

| Marine | 297.1 | +5.9% | 280.6 | 112.3 | 60.0% | 91.3% |

| Aviation | 377.3 | +3.7% | 364.0 | 70.5 | 93.6% | 99.3% |

| Credit, surety and political risks | 605.6 | +14.0% | 531.4 | 63.7 | 98.9% | 96.9% |

| UK, Ireland, London market and direct business | 519.7 | +17.6% | 442.0 | 153.7 | 86.6% | 98.7% |

| Facultative reinsurance | 1,120.7 | +17.0% | 957.6 | 118.3 | 94.1% | 96.9% |

| Global reinsurance | 3,492.1 | +28.9% | 2,708.4 | 377.7 | 93.1% | 94.8% |

| Worldwide treaty reinsurance | 1,810.4 | +22.3% | 1,480.7 | 165.7 | 95.7% | 94.7% |

| Catastrophe XL (Cat XL) | 374.9 | +20.9% | 310.0 | 154.6 | 50.2% | 82.2% |

| Structured reinsurance and Insurance-linked securities | 1,306.8 | +42.4% | 917.7 | 57.4 | 98.4% | 98.9% |

Target markets

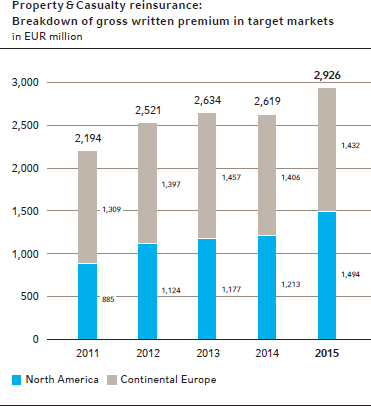

Hannover Re classifies North America and Continental Europe as target markets. The premium volume increased by 11.7% to EUR 2,925.5 million (EUR 2,619.4 million). Growth thus came in stronger than originally forecast. The combined ratio slipped from 92.5% to 99.0%, as a consequence of which the operating profit (EBIT) retreated accordingly to EUR 445.2 million (EUR 507.6 million).

North America

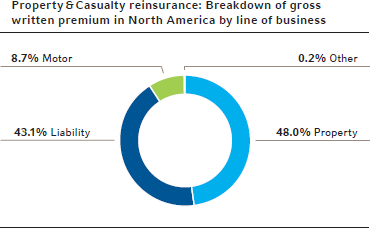

The North American (re)insurance market is the largest single market both worldwide and for Hannover Re. Our business here is written almost exclusively through brokers.

The continued moderate growth of the US economy in 2015 served to boost the premium volume in the primary insurance market; the rate level, which had been rising since 2011, stabilised on the level of the previous year. Given the continued absence of significant natural catastrophe events in the United States and with low inflation rates offering room to write back reserves, both insurance and reinsurance companies were able to show healthy profits.

The more comfortable capital resources available to market players and the additional risk-carrying capacity offered by alternative capital led to renewed pressure on reinsurance rates, albeit to a lesser extent than had originally been anticipated. Proportional property business was broadly stable, although conditions deteriorated in some areas. Rates in non-proportional US catastrophe business fell in response to the inflow of capacity from alternative markets and on account of higher retentions carried by ceding companies, although the pace of erosion slowed.

Loss-impacted programmes saw positive price adjustments. Although general liability business came under heavier rate pressure, as reflected in coverage extensions and more generous limits of liability as well as increased cost reimbursements, rate increases were booked in some instances in the professional indemnity lines. Greater awareness of cyber risks led to stronger demand. Opportunities also opened up in the reinsurance of M & A activities. In addition, we were able to further enlarge our business relationship with a long-standing customer in the context of a large-volume treaty.

Hannover Re is very well positioned in the North American market and thanks to its excellent rating, its financial standing and its experience the company is a valued partner for its clients. Especially in long-tail liability business, this is of the utmost importance. Thanks to our access to the entire market spectrum, we were particularly successful in further diversifying our portfolio and writing additional profitable business in the financial year just ended.

On the claims side North America experienced a number of smaller natural catastrophe events, which resulted in merely moderate losses for reinsurers. This was particularly the case with the hurricane season, which again passed off thoroughly benignly in the year under review. Hannover Re incurred sizeable losses in the United States from, inter alia, the winter storm in February (EUR 12.8 million), forest fires (EUR 9.3 million) as well as a storm and flooding in May / June (EUR 7.3 million).

Despite the competitive climate and our margin-oriented underwriting policy, the gross premium for our business in North America rose by 23.1% to EUR 1,493.8 million (EUR 1,213.4 million). Adjusted for exchange rate effects, North American business booked growth in the mid-single-digit percentage range. The combined ratio deteriorated in the year under review to 99.6% (91.8%). The operating profit (EBIT) fell to EUR 242.0 million (EUR 258.2 million).

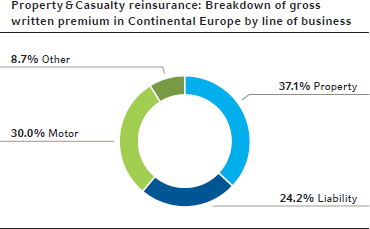

Continental Europe

We group together the markets of Northern, Eastern and Central Europe as Continental Europe. The largest single market here is Germany. The premium volume for our business in Continental Europe in the year under review came in at EUR 1,431.7 million (EUR 1,406.1 million). The combined ratio stood at 98.4% (93.1%). The operating profit (EBIT) amounted to EUR 203.2 million and thus fell short of the previous year’s good performance (EUR 249.4 million).

Germany

The German market – the second-largest in the world for property and casualty reinsurance – is served within the Hannover Re Group by our subsidiary E+S Rück. As the “dedicated reinsurer for Germany”, the company is a sought-after partner thanks to its very good rating and the continuity of its business relationships. E+S Rück is superbly positioned in its domestic market and a market leader in property and casualty reinsurance.

The German market was similarly shaped by oversupply on the reinsurance market, putting pressure on conditions – especially in short-tail business. Furthermore, ceding companies are raising their retentions in order to meet internal cost pressure – especially associated with regulatory requirements such as Solvency II.

Loss expenditure caused by natural disasters was slightly higher than in the previous year, driven above all by winter storm “Niklas” in late March / early April. The German Insurance Association (GDV) estimates that losses from natural catastrophe events cost the insurance industry around EUR 2.1 billion. Roughly one third of the total loss burden can be attributed to winter storm “Niklas”, which – with damage to insured buildings put at EUR 750 million – ranks among the five most severe winter storms since 1997.

The diverging developments in property and casualty insurance in Germany became even more marked in the year under review: while the premium quality in retail lines improved, especially in motor and homeowners business, industrial lines – above all fire insurance – remained fiercely competitive. A further factor is that loss ratios here have been rising steadily since the beginning of the decade and no further underwriting profits have been generated market-wide. Not only were very large individual losses (in some cases more than EUR 250 million) recorded in 2015, the number of claims also increased sharply.

Claims expenditure in motor own damage insurance was in line market-wide with the multi-year average. Despite tariff improvements in the primary market, the increased loss burden compared to the previous year caused the combined ratio to deteriorate slightly. Using highly specialised analysis tools, we assist our customers with the individual exposure mapping of their own damage portfolios and draw on these insights to develop bespoke reinsurance solutions.

Premium income from motor liability insurance rose again in 2015 – on the back of modest tariff increases in the previous years. Allowing for the run-off from previous years, the combined ratio for the year as a whole is likely to reach a level of roughly 100% market-wide. General liability business in Germany will similarly see the technical income statement close in positive territory. Growing demand could be observed here for cyber covers, although the associated premium volume is still very minimal. All in all, we are satisfied with the premium contribution from our German business.

Rest of Continental Europe

European markets are still intensely competitive; this is true not only of countries in Central and Eastern Europe but also of most mature markets such as France and Northern Europe. Along with difficult economic conditions, surplus capacities put the insurance industry under strain; rate reductions and poorer conditions were therefore once again a feature of the Northern European and French markets, especially in the industrial lines. We nevertheless succeeded in maintaining our market share, in part by increasing our shares with selected cedants and also by writing additional business in less competitive lines. In longtail liability business, especially on the motor side, we are still seeing a challenging climate and participate only selectively.

Developments in Central and Eastern Europe were overshadowed by political tensions and the associated economic impacts. The primary insurance market consequently saw a contraction in premium income, with corresponding implications – exacerbated by the competition – for the reinsurance market. In the year under review, however, it was largely possible to obtain risk-appropriate rates and conditions and hence we were able to generate satisfactory results with a somewhat smaller premium volume. On the claims side the region was impacted by numerous small and mid-sized events.

Specialty lines worldwide

Under specialty lines we include marine and aviation reinsurance, credit and surety reinsurance, business written on the London Market as well as direct business and facultative reinsurance.

The premium volume for specialty lines amounted to EUR 2,920.4 million (EUR 2,575.6 million) in the year under review. The combined ratio improved from 100.2% to 90.9%. The operating profit (EBIT) for specialty lines surged to EUR 518.5 million (EUR 169.4 million).

Marine

After years of satisfactory rates, the marine reinsurance market is currently experiencing a soft market phase. In the treaty renewals at the beginning of 2015 price declines running into double-digit percentages were recorded as a consequence of the relatively low expenditure on marine losses. The insurance market for offshore energy risks has been facing substantial surplus capacities for around 18 months now. The drop in oil prices has also cut into demand. Despite some strains from man-made losses, reinsurance prices for coverage of such risks therefore continued to decline.

In 2015 the series of explosions in the Chinese port city of Tianjin caused a market loss in the range of USD 2 to 3 billion, a not inconsiderable part of which impacted marine reinsurance. The net loss for our share across all lines amounted to EUR 111.1 million. Further large losses incurred in the market were attributable principally to damaged oil rigs in the Gulf of Mexico. We therefore adjusted our underwriting policy along more conservative lines and relinquished business that offered little prospect of profitability.

Driven in part by positive exchange rate effects, gross premium for our marine portfolio increased by 5.9% to EUR 297.1 million (EUR 280.6 million). Despite the aforementioned loss expenditure the combined ratio improved to 60.0% (67.2%) and the underwriting result moved correspondingly higher. The operating profit (EBIT) climbed to EUR 112.3 million (EUR 85.7 million).

Aviation

Results in international aviation (re)insurance were once again impacted in the year under review by a number of losses, including what investigations currently indicate was the deliberate crash of a German aircraft. At the same time, the space market was faced with the largest single loss in its history.

The significant major losses recorded in 2014 had only a very limited positive effect on the rate trend in 2015. This can be attributed above all to the unchanged abundant supply of insurance capacity. Rate increases in the market for war covers similarly fell short of expectations. We adhered to our disciplined underwriting strategy in this soft market phase and kept a clear focus on non-proportional business. In this segment we operate as one of the market leaders, in contrast to our selective stance on writing proportional acceptances.

The premium volume for our total aviation portfolio rose slightly from EUR 364.0 million in the previous year to EUR 377.3 million. Total expenditure on large losses was lower than in the previous year at EUR 51.3 million; the combined ratio consequently improved to 93.6% (112.1%) and came in below the target level for the maximum tolerable combined ratio (99.3%). The operating result (EBIT) improved to EUR 70.5 million (-EUR 2.4 million).

Credit, surety and political risks

Hannover Re ranks among the market leaders in worldwide credit and surety reinsurance.

While the development of the worldwide economy in 2015 can be described as robust overall, economic conditions in certain regions – including for example in Southern Europe, emerging markets and especially China – were difficult. Global growth in the primary insurance market therefore remained minimal. The increased risk-carrying capacity of ceding companies has led to a drop in reinsurance cessions in some areas. We write a large share of our business with credit, surety and political risks in the form of proportional treaties, under which cost reimbursements in the year under review increased only moderately.

Gross premium income in these lines grew by 14.0% in 2015 to EUR 605.6 million (EUR 531.4 million). The premium growth was boosted by exchange rate effects, the acquisition of new customers and the expansion of existing client relationships.

The claims frequency in credit and surety business increased considerably in the year under review, most strikingly in emerging markets. A few sizeable insolvency losses were also recorded, including for example a Spanish engineering and energy group. The loss ratio in political risk insurance also rose slightly from a low level. The combined ratio of 98.9% for the entire segment was thus significantly higher than in the previous year (92.2%) and exceeded our maximum tolerable target ratio of 96.9%. The operating profit (EBIT) contracted by 26.9% to EUR 63.7 million (EUR 87.2 million).

United Kingdom, London market and direct business

United Kingdom, Ireland and the London Market

The property and casualty business that we reinsure for companies in the United Kingdom and on the London market developed largely satisfactorily in 2015. The intense competition in the primary sector was sustained and led to rate reductions. Exceptions here were UK motor business and parts of the Irish primary insurance portfolio. On the reinsurance side a similar picture emerged. While rates in non-proportional UK business remained stable or rose slightly at the beginning of 2015 – after sometimes appreciable increases in the years from 2011 to 2014 –, they came under more pronounced pressure in the other property and casualty lines. We managed our portfolio in keeping with our cycle management and scaled back our shares in programmes under which the prices or conditions were not considered attractive. Major losses were incurred in the form of severe flooding in the United Kingdom, for which we reserved an amount of EUR 28.3 million, as well as fire losses in a number of markets including France and Northern Europe.

Direct business

We also write direct business through our subsidiary International Insurance Company of Hannover SE (Inter Hannover). This essentially involves tightly defined portfolios of niche or other non-standard business that complements our principal commercial activity as a reinsurer.

We transformed the company into a Societas Europaea (SE) in 2014 and moved its registered office to Hannover at the beginning of 2015. The purpose was to interlink more closely the business management units and to leverage potential synergies and economies of scale in the administration of the business. We write a large portion of our direct business in the London Market and through our Swedish branch. The result of our direct business was significantly improved in the financial year just ended. This is a respectable achievement, especially bearing in mind the intensive competition among the insurers and reinsurers operating in this sector.

The gross premium booked from the United Kingdom, London market and direct business climbed – as indicated in the renewals as at 1 January 2015 – by 17.6% from EUR 442.0 million to EUR 519.7 million. A good portion of the growth was driven by positive exchange rate effects. The combined ratio stood at 86.6% (110.3%). The operating result (EBIT) improved accordingly to EUR 153.7 million (-EUR 12.8 million).

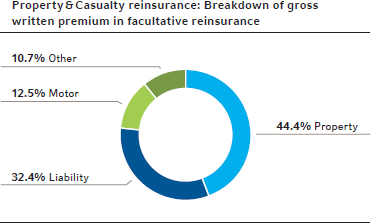

Facultative reinsurance

In contrast to obligatory reinsurance, a reinsurer underwrites primarily individual risks in facultative business. The general environment for both types of reinsurance in the various markets is, however, for the most part comparable.

Heavy rate erosion and diminished demand for coverage of offshore and onshore risks were all but offset by increased acceptances in the areas of renewables, cyber risks and personal accident / sports covers. Yet even in these segments the effects of the soft market could be felt. Rate movements therefore varied across regions and markets, although the overall trend was still downwards.

We are largely satisfied with the development of our overall facultative portfolio in the year under review, despite the protracted soft market environment: we grew our business and further diversified the portfolio. The premium volume increased to EUR 1,120.7 million (EUR 957.6 million). The organic growth was favourably influenced by a strong US dollar and a non-recurring special effect associated with the less deferred booking of premiums. An unusually high frequency of mid-sized losses was incurred from various regions and lines in the 2015 financial year. The combined ratio was particularly heavily impacted by damage to oil exploration equipment in the Gulf of Mexico and refineries, although fire losses at industrial facilities and some isolated liability claims were also contributory factors. Major losses nevertheless did not reach the level of the previous year. The combined ratio of 94.1% was below that of the previous year (103.9%). The operating profit (EBIT) improved accordingly to EUR 118.3 million (EUR 11.8 million).

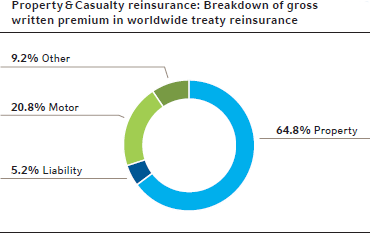

Global reinsurance

We combine all markets worldwide under global reinsurance with the exception of our target markets and specialty lines. This segment also encompasses global catastrophe business, the reinsurance of agricultural risks, Sharia-compliant retakaful business as well as structured reinsurance and insurance-linked securities.

The premium volume increased by 28.9% in the year under review to EUR 3,492.1 million (EUR 2,708.4 million). The combined ratio deteriorated slightly from 91.6% to 93.1%. The operating profit (EBIT) declined from EUR 513.8 million to EUR 377.7 million.

Worldwide treaty reinsurance

We are satisfied with the development of our worldwide treaty reinsurance portfolio. The gross premium volume grew in line with our expectations to EUR 1,810.4 million (EUR 1,480.7 million). The combined ratio improved from 98.5% to 95.7%. The operating profit (EBIT) retreated to EUR 165.7 million (EUR 225.6 million).

Asia-Pacific region

The Asia-Pacific countries continue to be a growth region for Hannover Re, and with this in mind we further expanded our position in the year under review. Developments in the individual markets varied widely; the region was the scene of increasing competition on account of the available growth opportunities. Although the loss expenditure incurred in certain markets was striking, it can still be assessed as satisfactory overall.

Japan remains one of the most important regional markets in the Asia-Pacific for the Hannover Re Group. The year under review was notable for a very active typhoon season. Storm “Etau” caused a major loss for Hannover Re that we reserved in the amount of EUR 27.3 million. The other lines written here closed the period under review with mostly positive results.

Thanks to our historically broad positioning with the major Japanese insurance groups in the Asia-Pacific region and worldwide, the Hannover Re Group was also able to hold its premium income stable despite sustained pressure on reinsurance conditions in the last April renewals.

In China Hannover Re once again booked double-digit growth in the year under review. We are present in the country with a locally licensed branch and have systematically pursued the successful strategy of the previous years – namely consolidating our business relationships with selected clients. Our business already benefited in the year under review from the upcoming implementation of the risk-based solvency system C-ROSS effective 1 January 2016, which favours local reinsurance placements. Results were, however, hard hit by the extraordinary series of explosions at the Port of Tianjin; the insured market loss from this accident is estimated to be in the range of EUR 2 to 3 billion.

Almost all primary insurance markets in South and Southeast Asia are growing disproportionately strongly compared to the more mature Asian markets. In this region Hannover Re is represented by a branch in Kuala Lumpur. We further improved our market penetration and generated strong growth in the year under review. In keeping with our strategy, the prevailing conditions – which were shaped by the intense competitive forces – prompted us to successfully expand new, less hardfought business segments and optimise our risk balance.

After the Indian government had opened the way in 2015 for foreign reinsurers to set up branches, we embarked on intensive preparations for the licensing process. In so doing, we are aiming to strengthen our market presence and boost our growth prospects.

In Australia and New Zealand, contrary to expectations, Hannover Re achieved vigorous growth by realising sizeable transactions with a number of target customers. In the first half of 2015 the region was impacted by an unusual frequency of midsized and smaller natural catastrophe losses. Given that the Hannover Re Group is the third-largest provider of reinsurance protection in the Australian market, our results were initially adversely affected by these events. As the financial year drew to a close, however, the overall result posted by the Australian permanent establishment proved to be encouragingly positive. This was facilitated by the high retentions carried by local ceding companies, the selective underwriting policy practised by our underwriters and a favourable run-off result.

South Africa

Our property and casualty reinsurance business in South Africa is generated by three companies. Hannover Reinsurance Africa Limited writes reinsurance in all lines – including specialty lines, which are written in close consultation with departments in Hannover. Compass Insurance writes direct business through so-called underwriting management agencies (UMAs). The third company, Lireas Holdings, holds interests in several of these UMAs. This enables us to comprehensively steer and control the business. Agency business forms the pillar of our activities in South Africa, although reinsurance business is also written on the open market in South Africa and other African countries.

This market continues to be characterised by its relatively low insurance density; most vehicles on public roads, for example, are uninsured. Despite this, the insurance market showed only marginal growth in the year under review, although the results posted by insurers were significantly better than in the previous year. This can be attributed above all to a lower frequency of large and catastrophe losses.

Against this backdrop, both Compass Insurance and Hannover Reinsurance Africa performed appreciably better in the 2015 financial year and delivered pleasing results. The premium volume contracted owing to negative exchange rate effects and expected shifts into large-volume, structured reinsurance arrangements.

Latin America

Hannover Re is very well positioned in Latin America and a market leader in some countries. The most important markets for our company are Brazil, where we are present with a representative office, as well as Mexico, Argentina, Colombia and Ecuador.

Most Latin American markets have enjoyed very vigorous growth in recent years and are still showing solid gains. Primary insurance premiums are increasing by between 5% and 15% a year depending on the market. With natural catastrophe risks highly exposed, the strong demand for reinsurance covers remains undiminished. In Latin America, too, the reinsurance market finds itself experiencing a soft phase. Premium income on the reinsurance side contracted in 2015 owing to the devaluation of some Latin American currencies and due to the higher retentions carried by primary insurers.

A survey of cedants conducted by the trade magazine “Intelligent Insurer” confirmed our excellent position. Our clients named us as a preferred partner in all categories. In Argentina, despite the restrictions placed on foreign reinsurers, we succeeded in preserving our market leadership. We wrote our business increasingly selectively in order to generate our required margins. In Brazil we maintained our position in the face of ongoing market concentration on the primary insurance side.

Losses from natural disasters were again on the moderate side for the (re)insurance industry in the year under review. The earthquake in Chile gave rise to net loss expenditure of EUR 25.5 million for Hannover Re. Overall, we are satisfied with the development of our business in Latin America.

Agricultural risks

The insurance of agricultural risks was one of Hannover Re’s fastest growing segments in 2015. We further expanded our market position and rank among the preferred partners for agricultural covers. In addition, we have been taking an increasingly active role in product development. We entered into cooperative ventures with governments and international organisations in the year under review with a view to expanding the protection of agricultural risks.

Rates and conditions remained broadly stable on the primary insurance side. Conditions in reinsurance business came under pressure in the established markets due to new market players.

We were successful in our efforts to further diversify our portfolio mix in terms of both countries and lines of business; a contributory factor here, for example, was an enlarged share of business involving insurance products for small farmers, predominantly in emerging and developing countries. Growth was also driven by the expansion of a long-standing customer relationship in the United States.

We are satisfied with the development of our agricultural risks business. The major loss situation was comparatively moderate in 2015. Hail events, droughts and floods had little or no impact on our portfolio. To this extent, a healthy profit contribution was generated on the back of the further improvement in our diversification in this segment.

Retakaful business

We write retakaful business, i. e. reinsurance transacted in accordance with Islamic law, worldwide. Our focus is currently on the Middle East, North Africa and Southeast Asia. This business is written by our subsidiary in Bahrain. We also maintain a branch that is responsible for writing traditional reinsurance in the Middle East and North Africa. Our retakaful business has been growing very vigorously for a number of years and we are satisfied overall with its development.

Bearing in mind that takaful and retakaful markets have now become fiercely competitive – in part due to the entry of new market players –, rates remain under sustained pressure. Hannover Re has been active in retakaful business since 2006 and the company is strongly positioned. We were particularly successful in growing our motor portfolio in the year under review; the largest single line is industrial fire business.

Natural catastrophe business

We write the bulk of our catastrophe business out of Bermuda, which has established itself as a worldwide centre of competence. In the interest of diversifying the portfolio our subsidiary Hannover Re (Bermuda) Ltd. has also written some of the specialty lines since 2013.

With major losses again lower than expected and hence the associated good results posted by insurers and reinsurers, and in view of the increasing capacities made available by so-called alternative capital markets, competition was intense. Reflecting this situation, rates in US property catastrophe business fell further – albeit at a slowing pace. After the appreciable increases that we had booked in 2012 and 2013, rates in Japan softened as anticipated. Only in isolated cases, most notably under loss-impacted programmes, were improvements recorded. All in all, declining rates are the dominant feature of natural catastrophe business worldwide.

As in the previous years, losses were very much on the moderate side for both insurers and reinsurers and those losses that were incurred came in within the modelled claims expectations. The largest single losses under our natural catastrophe covers were the earthquake in Chile and the floods in the United Kingdom.

The gross premium volume for our global catastrophe business developed favourably in the year under review, assisted in part by exchange rate movements: it rose from EUR 310.0 million to EUR 374.9 million. The combined ratio deteriorated to 50.2% (39.3%). The operating profit (EBIT) came in at EUR 154.6 million (EUR 185.6 million).

Structured reinsurance and Insurance-Linked Securities

Structured reinsurance

Hannover Re is one of the largest providers in the world for advanced solutions or structured reinsurance solutions, the purpose of which – among other things – is to optimise the cost of capital for our ceding companies. In this area we offer bespoke alternative reinsurance solutions that provide solvency relief or protect our clients against basic losses in lower layers. The 2015 financial year was notable for growing demand, particularly with an eye to the implementation of Solvency II in Europe and other risk-based solvency regimes in various countries.

In keeping with our objective we continued to expand our customer base and further improved the regional diversification of our portfolio in the year under review. The premium volume in structured reinsurance increased again – in part driven by unchanged brisk demand for quota share arrangements in the motor line.

Insurance-Linked Securities (ILS)

Our activities in relation to the transfer of reinsurance risks to the capital market were highly successful in the financial year just ended. By way of example, we were able to renew the protection cover for Hannover Re known as the “K cession” – a modelled quota share cession consisting of non-proportional reinsurance treaties in the property, catastrophe, aviation and marine (including offshore) lines that has been placed inter alia on the ILS market for more than 20 years now – at an increased level of roughly USD 400 million for 2015.

In addition, we enable investors to participate in insurance and reinsurance risks. Our role can be that of initiator, arranger, structurer and / or fronter. The principal instruments are collateralised reinsurance and catastrophe bonds. Our business partners on the investment side include specialised ILS funds, pension funds and hedge funds as well as primary insurers, captives and other portfolio managers seeking risks that promote diversification. The exposure volume that we transferred to the capital market in 2015 in the form of catastrophe bonds was in excess of USD 1.5 billion, including more than USD 700 million for the Texas Windstorm Insurance Association (TWIA), over USD 300 million for the Massachusetts Property Insurance Underwriting Association (MPIUA) and another bond for California earthquake risks with a volume of USD 300 million. We also acted as co-manager in UnipolSai’s Azzurro transaction with a volume of more than EUR 200 million.

The currently available capital exceeds by far the opportunities for new investments in catastrophe bonds. This has prompted investors to look for other means of investing in the reinsurance sector. So-called collateralised reinsurance again enjoyed particularly strong growth in the year under review and exceeds market-wide the volume of funds invested in catastrophe bonds. Under collateralised reinsurance programmes the investor assumes reinsurance risks that are normally collateralised in the amount of the limit of liability. Hannover Re further stepped up its cooperation with selected fund managers in the area of collateralised reinsurance in the year under review and generated attractive margins on this business.

The gross premium volume in structured reinsurance and from ILS activities climbed from EUR 917.7 million to EUR 1,306.8 million. The combined ratio stood at 98.4% (94.1%). The operating profit (EBIT) amounted to EUR 57.4 million (EUR 102.6 million).

More Information

Topic related links within the report:

Topic related links outside the report:

- Hannover Re issues additional hybrid capital

- Non-Life Reinsurance

- Major Losses External Quicklink PageID nicht vergeben: 300